ORB - Trading strategy with MetaTrader 4

suitable for all indices, commodities, forex and stocks based on CFD such as

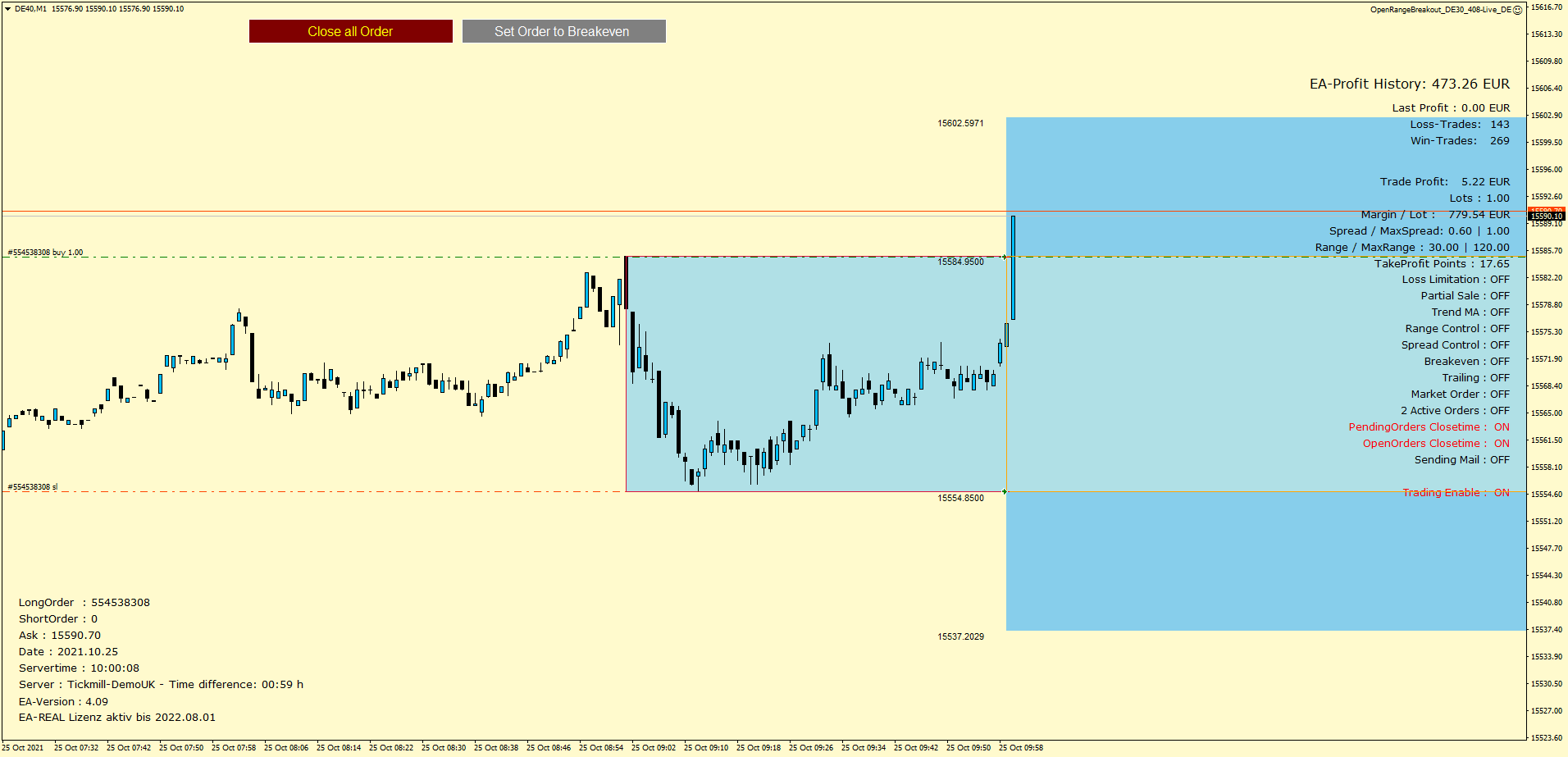

Expert Advisor - Fully automatic open range system for Metatrader 4

The Open Range Breakout strategy became popular in the 1980s. The book "Day Trading With Short Term Price Patterns and Opening Range Breakout" by

trader Toby Crabel is probably the best known for this strategy.

It is a fairly simple trading approach that is used by both professionals and beginners. In the pre-market opening phase, one or more stop entries are set in the market. These are then traded when the market breaks out.

With the ORB Expert Advisor you have a fully automatic trading system. This EA uses MetaTrader 4 as a platform. Some videos about the EA have already been published on the YouTube website.

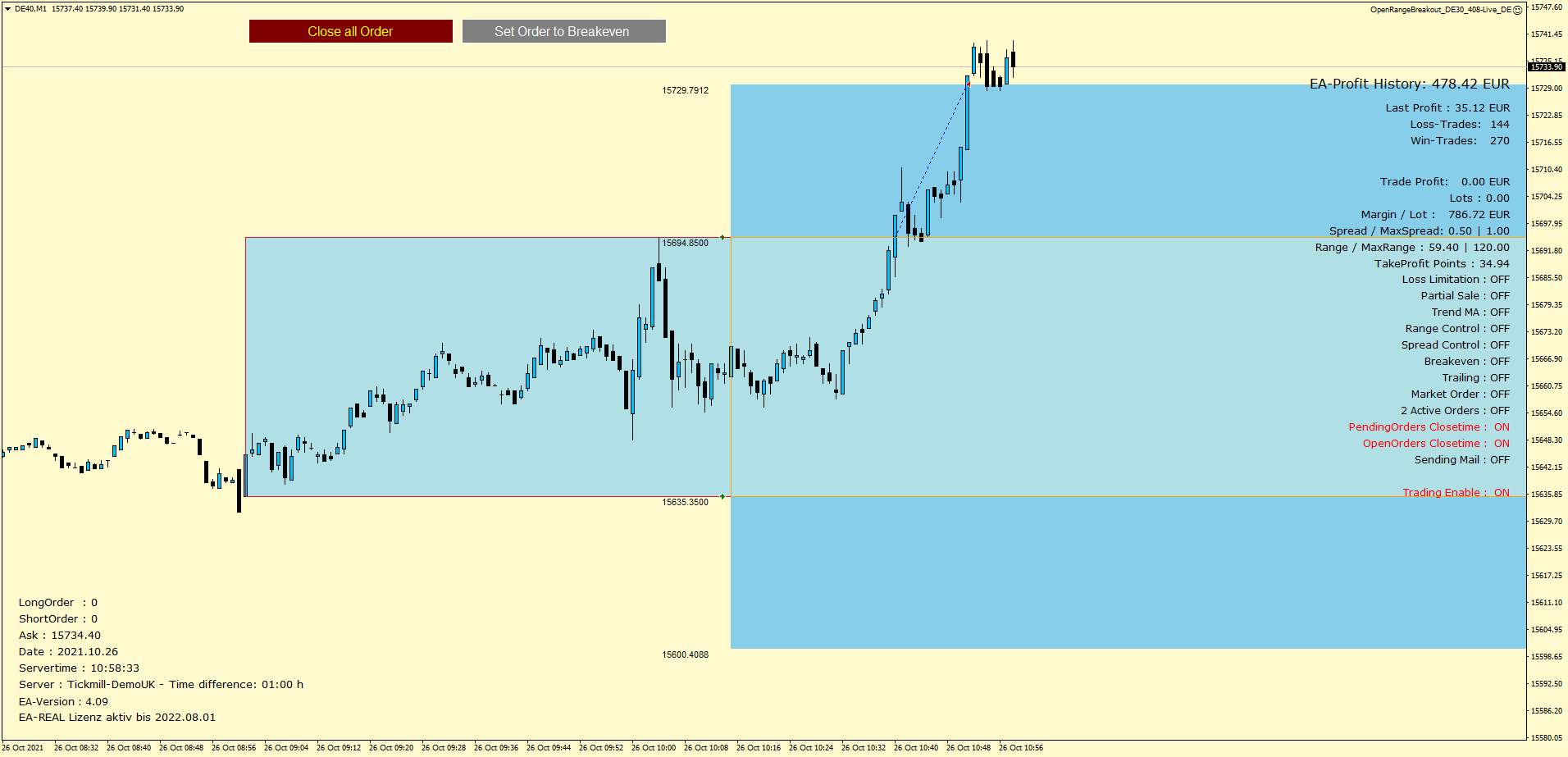

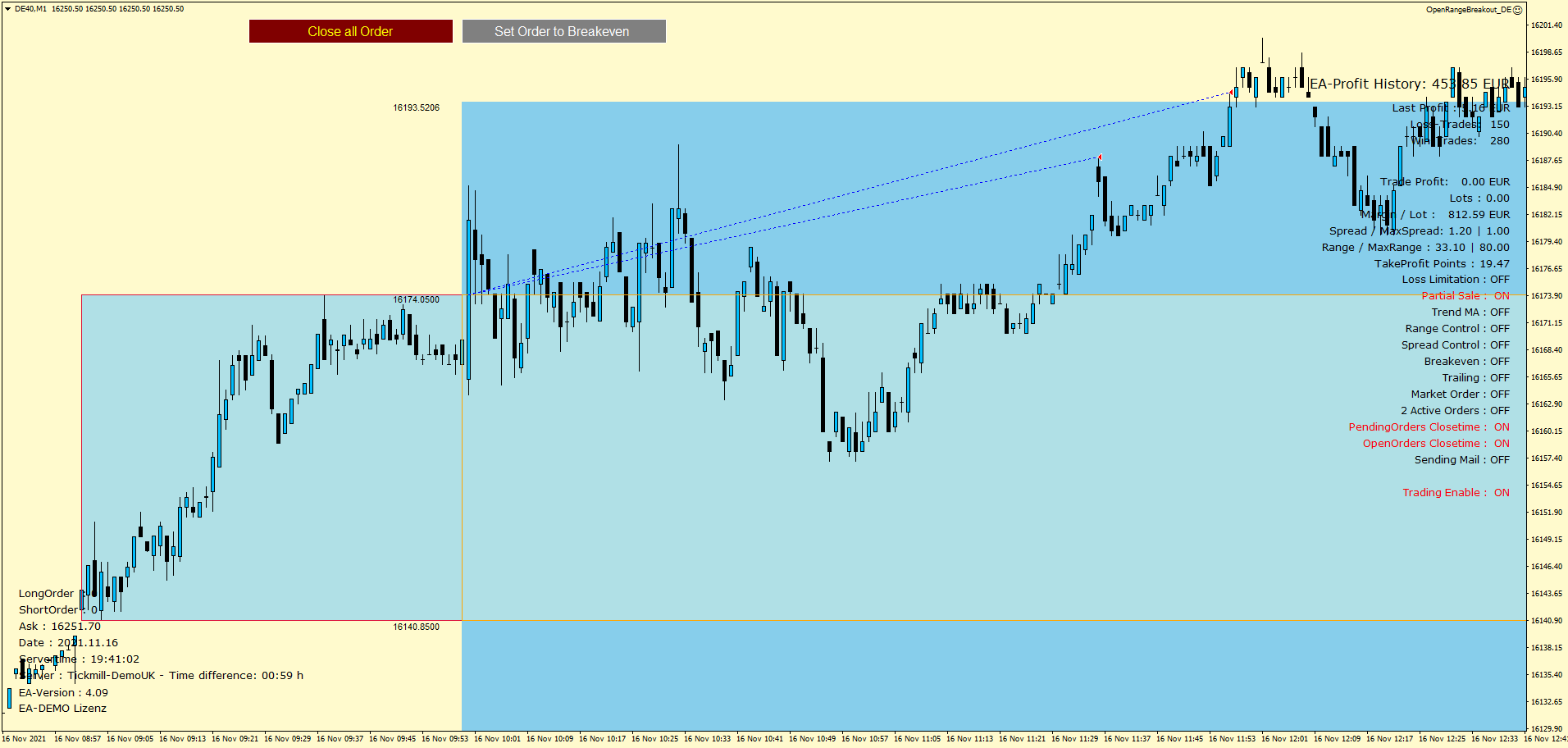

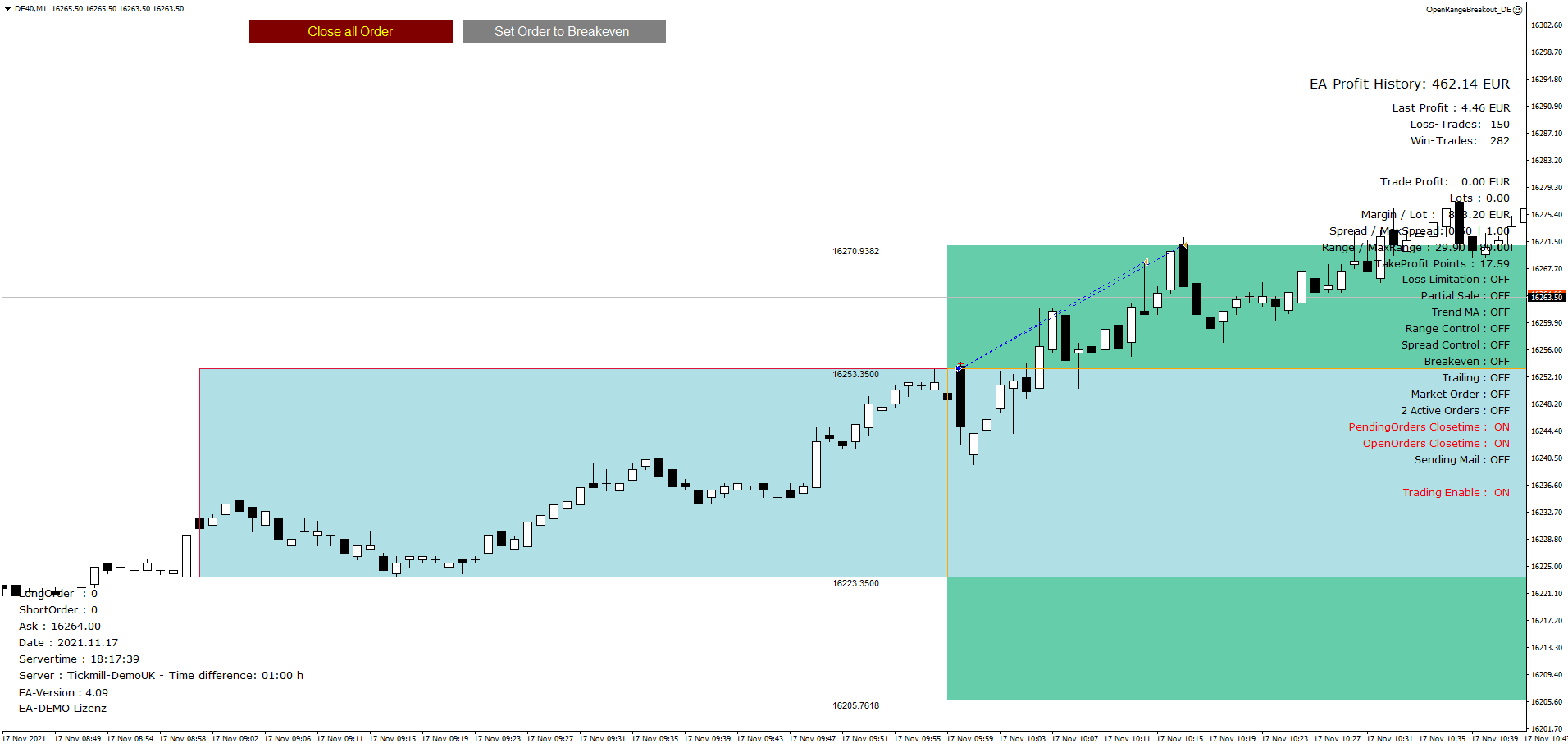

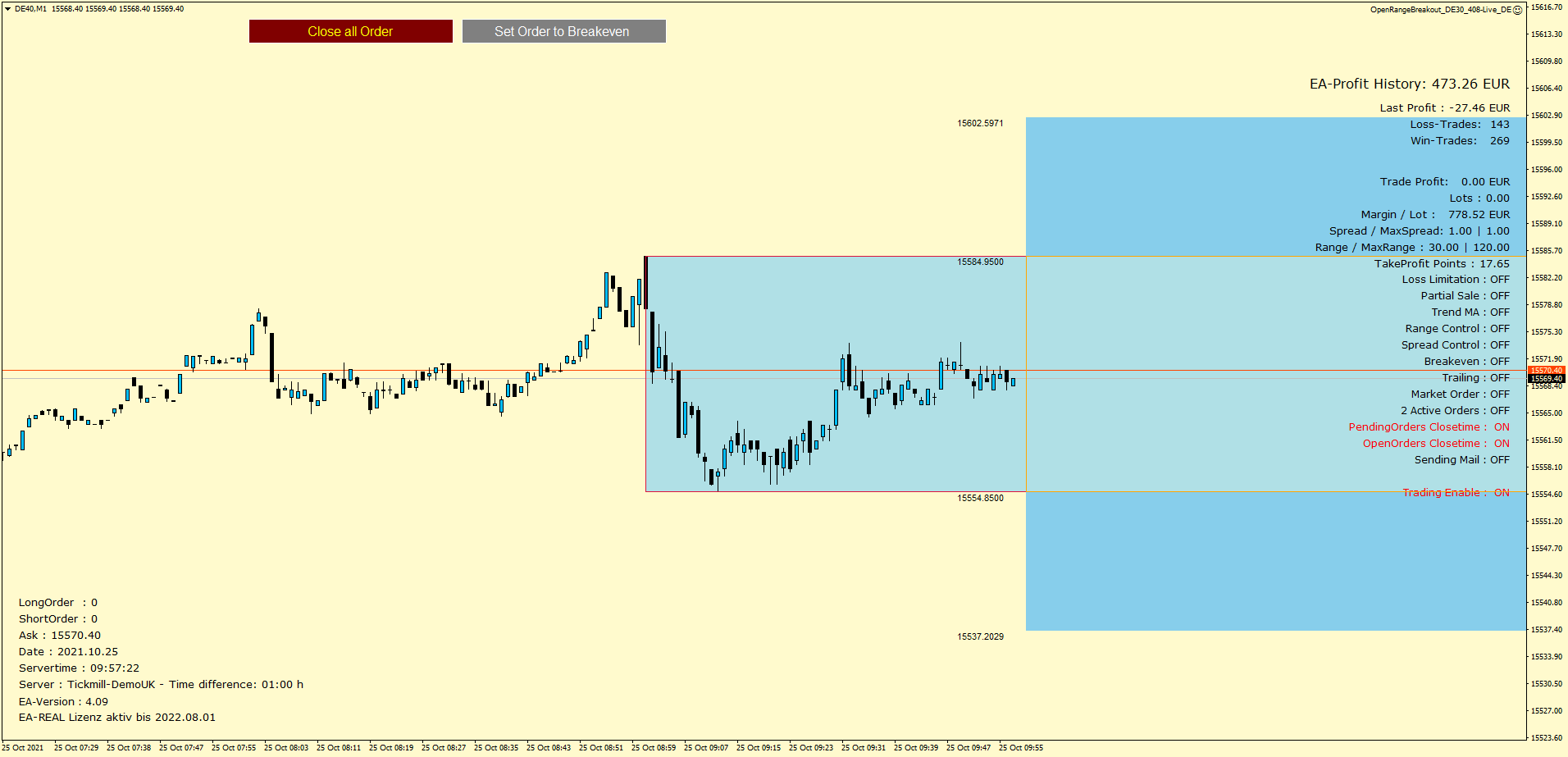

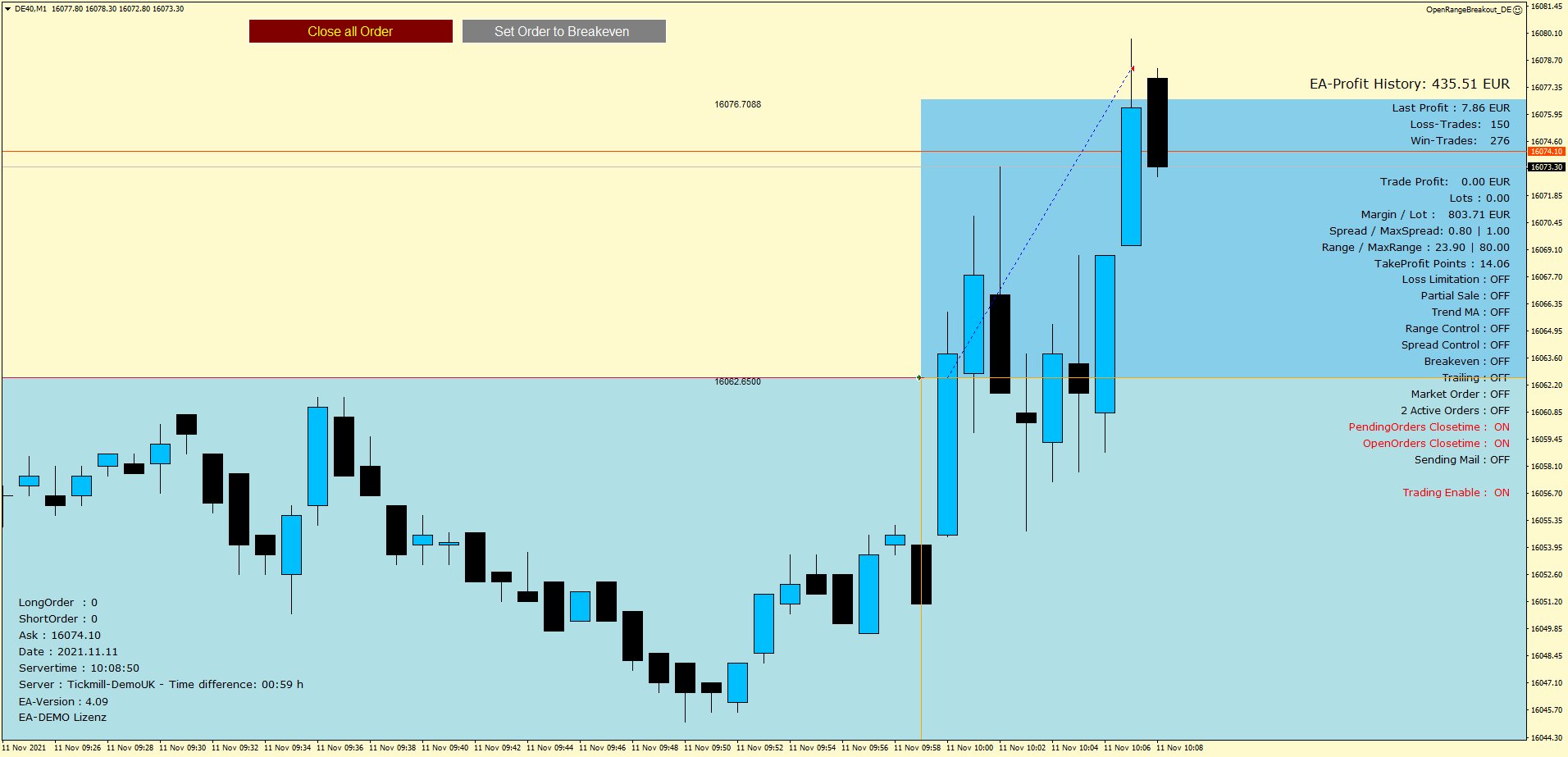

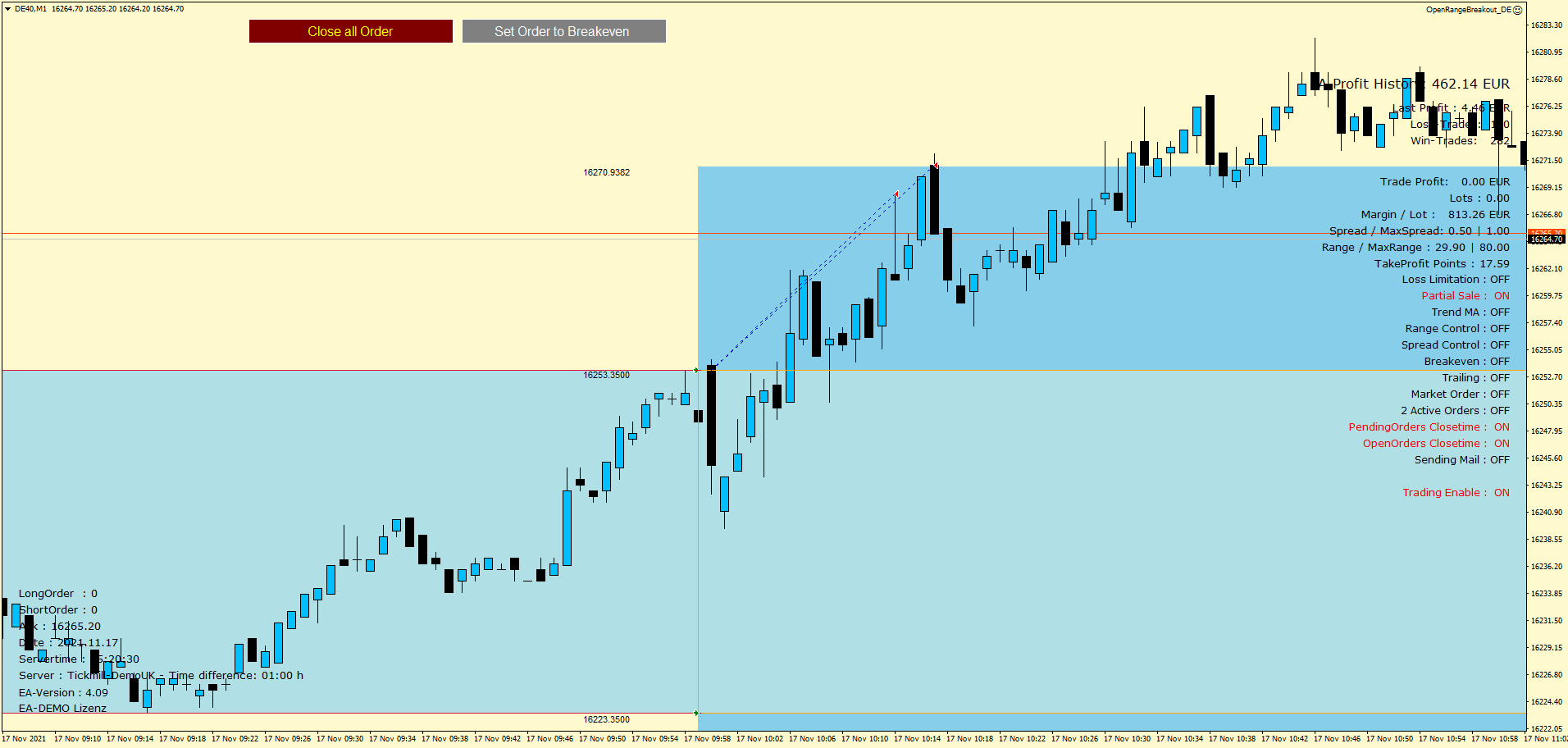

With this strategy - trading takes place in the 1 minute chart. The open range, also called the opening range, is set. A breakout is speculated on after the official market opening from this range. This strategy can be used in numerous markets such as stock indices (DAX, EuroStoxx, Dow, S&P 500 etc.), bonds (Bund future etc.), raw materials (WTI, Brent Oil etc.), precious metals (gold etc.), but also for individual stocks. Currencies such as (EUR/USD etc.) will soon be supported and delivered in an update.

There are many different approaches to setting the time frame of the open range. While some traders choose the high and low for the DAX between 9:00 and 10:00, others recommend using 8:00 and 9:00, 8:00 and 9:15, or 9:00 and 9:45, for example. Many traders prefer the DAX range from 8:01 to 9:00, as large jumps can occur again at 8:00, so they wait another minute.

For the Dow or S&P500, the first 45 minutes after the stock market opens are recommended as the time frame for the open range, which is usually between 3:30 and 4:15 p.m. But here too, every trader has their own strategy.

Included ORB - Expert Advisor functions according to MetaTrader version:

It is a fairly simple trading approach that is used by both professionals and beginners. In the pre-market opening phase, one or more stop entries are set in the market. These are then traded when the market breaks out.

With the ORB Expert Advisor you have a fully automatic trading system. This EA uses MetaTrader 4 as a platform. Some videos about the EA have already been published on the YouTube website.

With this strategy - trading takes place in the 1 minute chart. The open range, also called the opening range, is set. A breakout is speculated on after the official market opening from this range. This strategy can be used in numerous markets such as stock indices (DAX, EuroStoxx, Dow, S&P 500 etc.), bonds (Bund future etc.), raw materials (WTI, Brent Oil etc.), precious metals (gold etc.), but also for individual stocks. Currencies such as (EUR/USD etc.) will soon be supported and delivered in an update.

There are many different approaches to setting the time frame of the open range. While some traders choose the high and low for the DAX between 9:00 and 10:00, others recommend using 8:00 and 9:00, 8:00 and 9:15, or 9:00 and 9:45, for example. Many traders prefer the DAX range from 8:01 to 9:00, as large jumps can occur again at 8:00, so they wait another minute.

For the Dow or S&P500, the first 45 minutes after the stock market opens are recommended as the time frame for the open range, which is usually between 3:30 and 4:15 p.m. But here too, every trader has their own strategy.

Included ORB - Expert Advisor functions according to MetaTrader version:

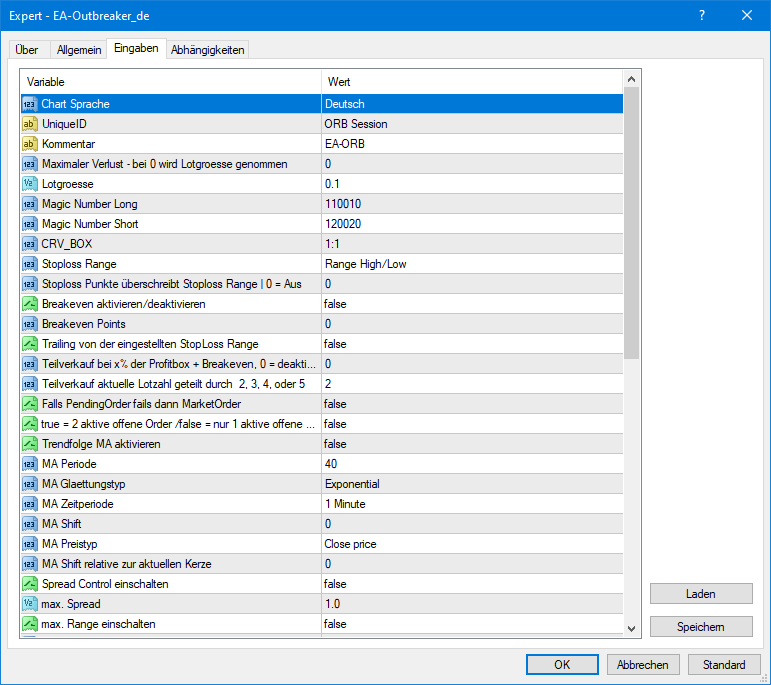

| Function | MT4 | MT5 |

|---|---|---|

| ➥ suitable for MetaTrader | X | X |

| ➥ Fully automated Expert Advisor | X | X |

| ➥ suitable for all indices, forex, commodities, stocks | X | X |

| ➥ Reduction of position through partial sale | X | X |

| ➥ fixed loss limit adjustable | X | |

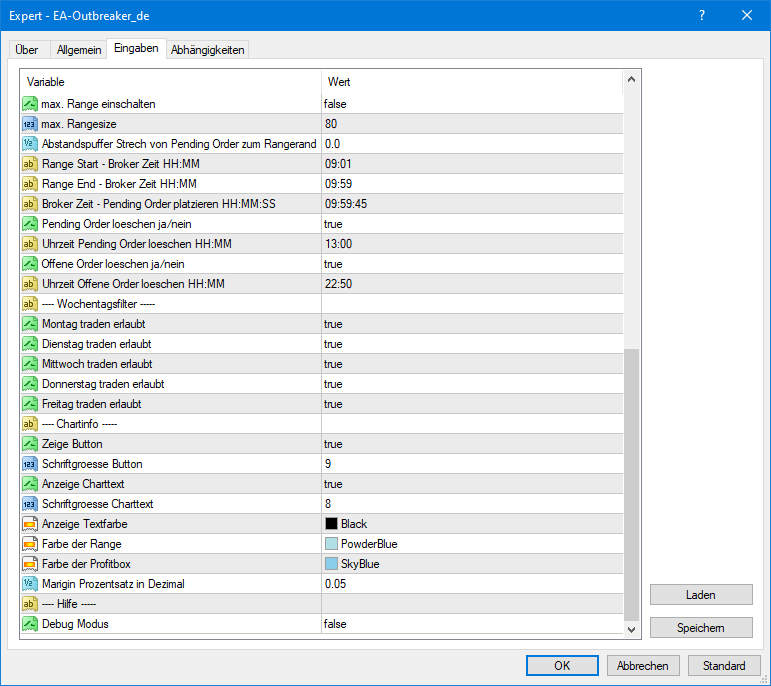

| ➥ temporal open range settings | X | X | ➥ adjustable maximum range size | X | X |

| ➥ Button for quick manual breakeven and OrderClose | X | X |

| ➥ Stoploss Range High-Low / Middle / High-Low of the profit box | X | X |

| ➥ individual stoploss points adjustable | X | |

| ➥ Trailing stops based on the set stop loss | X | X |

| ➥ Breakevenstop | X | X |

| ➥ Enable Spread Control | X | X |

| ➥ Enable Range Control | X | X |

| ➥ variable profit box with CRV settings | X | X |

| ➥ hidden take profit from the broker | X | |

| ➥ adjustable buffer (stretch) to range high and low | X | X |

| ➥ two pending orders at the high/low of the range | X | X |

| ➥ Pending order conversion to market order | X | X |

| ➥ one pending order deletes the other upon activation | X | X |

| ➥ or both orders remain active | X | X |

| ➥ time limit for active pending orders | X | X |

| ➥ Close time before market closure | X | X |

| ➥ Timeframe M1 | X | X |

| ➥ Email Alert | X | |

| ➥ time limit for active pending orders | X | X |

| ➥ Statistics display in EA | X | X |

| ➥ Trend settings possible via moving average | X | X |

| ➥ 3 year license - no automatic renewal | X | X |

| ➥ Installing the license on a Real account | X | X |

| ➥ Updates included | X | X |

| ➥ Helpdesk via website | X | X |

| ➥ Weekday filter | X | X |

| ➥ Chart color adjustment of the displayed boxes | X | X |

| ➥ Update check for newer version | X | X |

| ➥ Email support for Premium & Ultimate versions | X | X |