Revolutionize Your Breakout Trading with the Open Range Breakout Indicator for MT4!

Are you a trader or finance enthusiast looking for a powerful tool to optimize your trading strategies? The Open Range Breakout Indicator might be the solution you've been searching for.

The Open Range Breakout strategy became popular in the 1980s. The book "Day Trading With Short Term Price Patterns and Opening Range Breakout" by trader Toby Crabel is probably the most well-known publication on this strategy.

It's a relatively simple trading approach that is favored by both professionals and beginners. One or more stop entries are placed in the market during the pre-market opening phase. These are triggered by the market opening breakout.

With the ORB Indicator, you get a fully automated trading system. This EA uses MetaTrader 4 as the platform.

Several videos about its big brother – the ORB EA – are already available on YouTube.

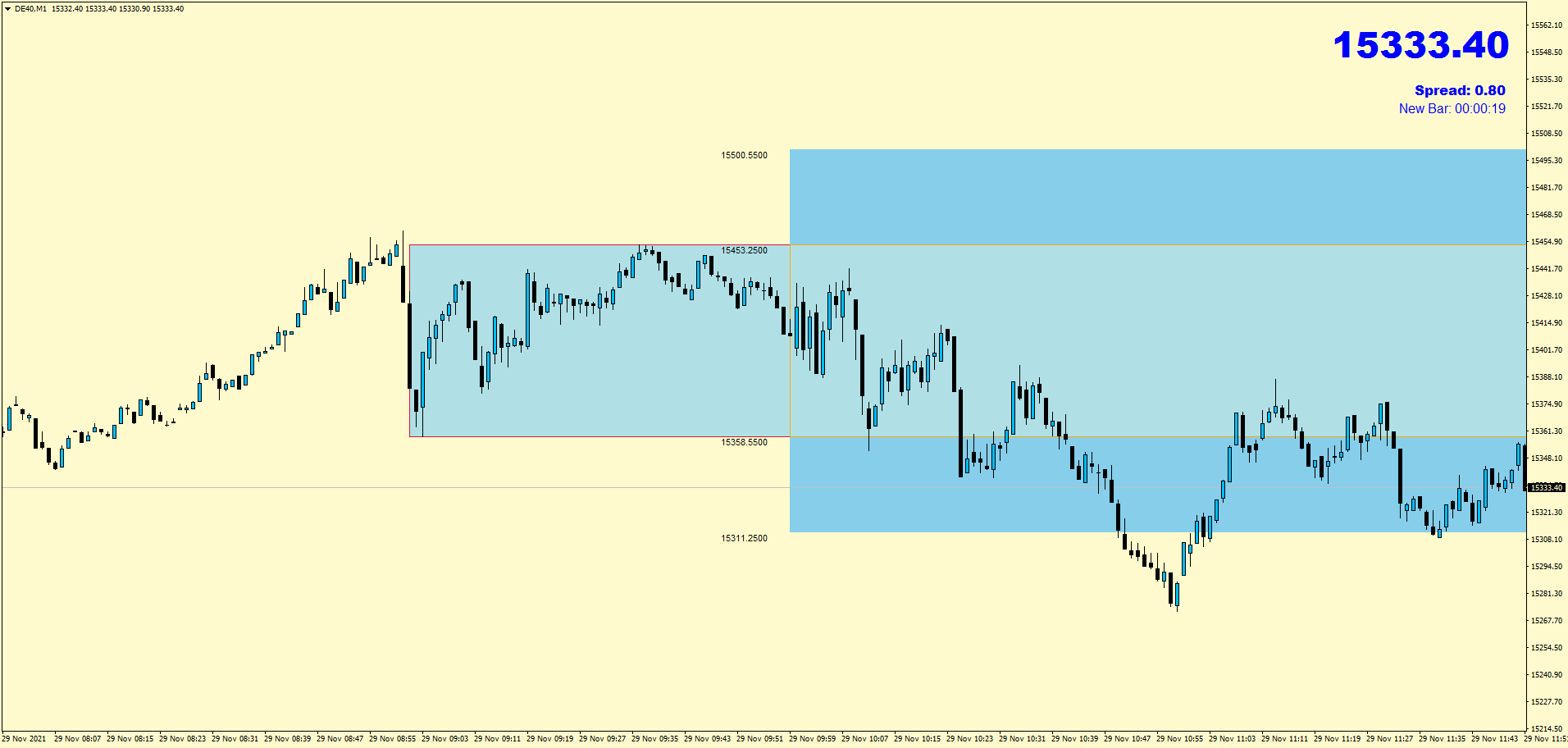

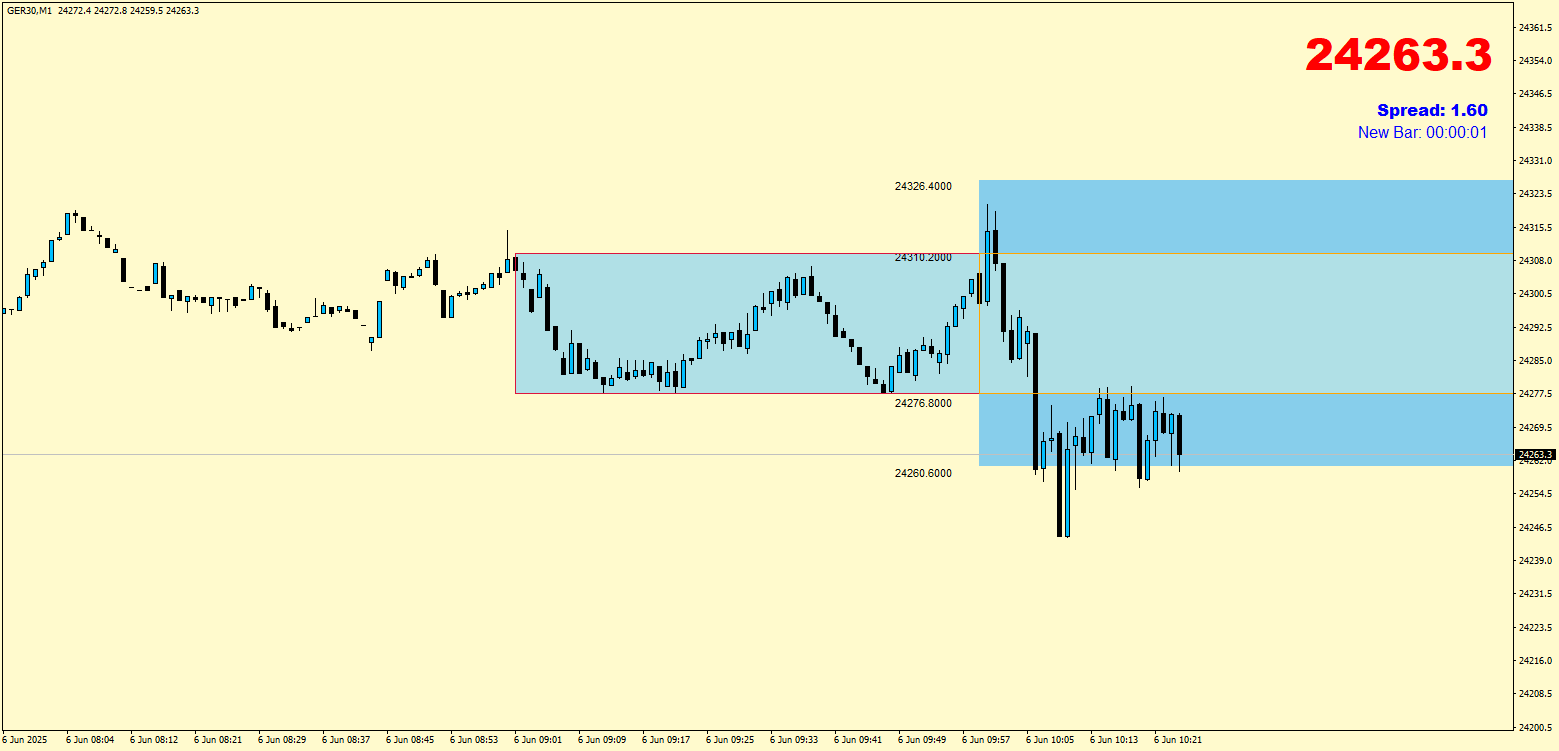

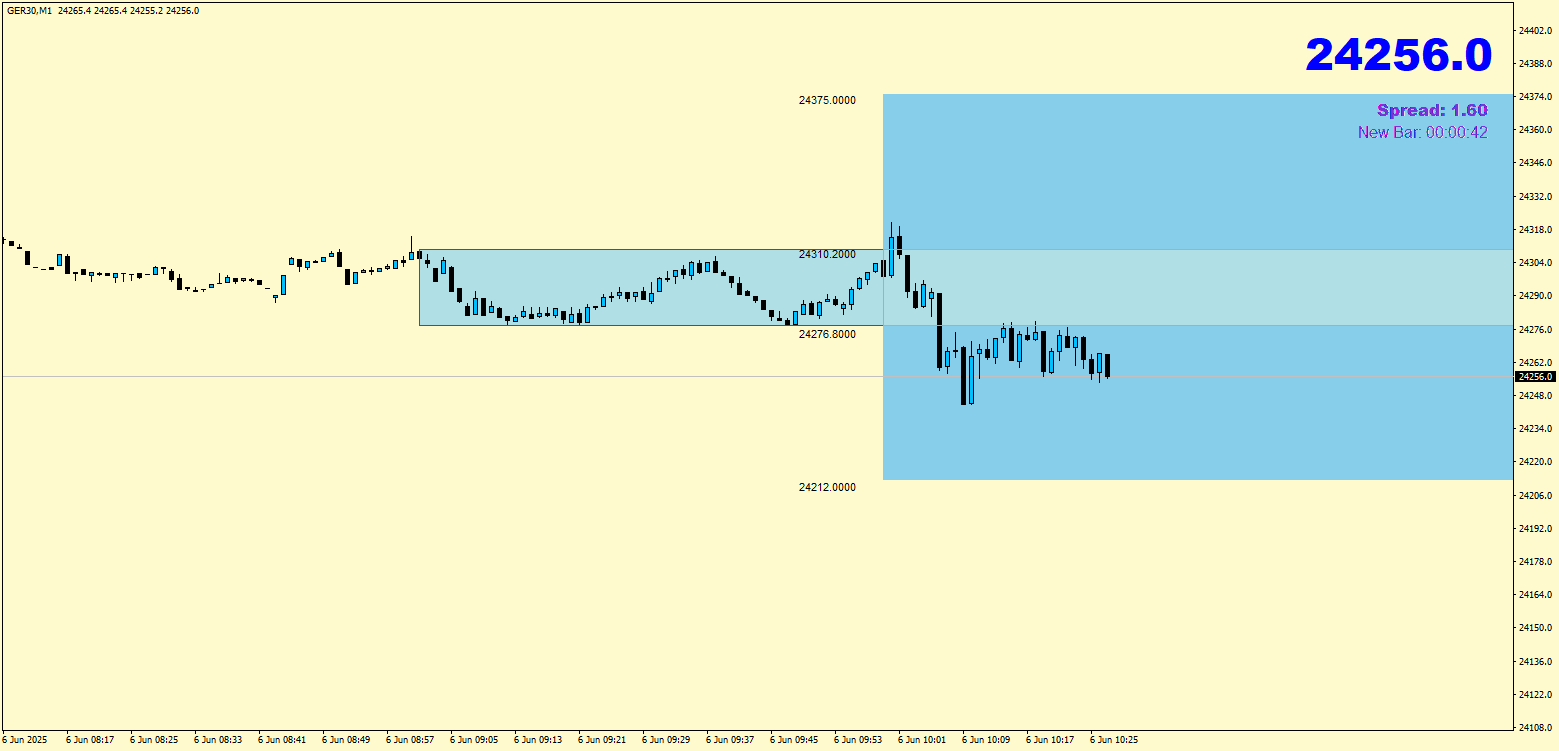

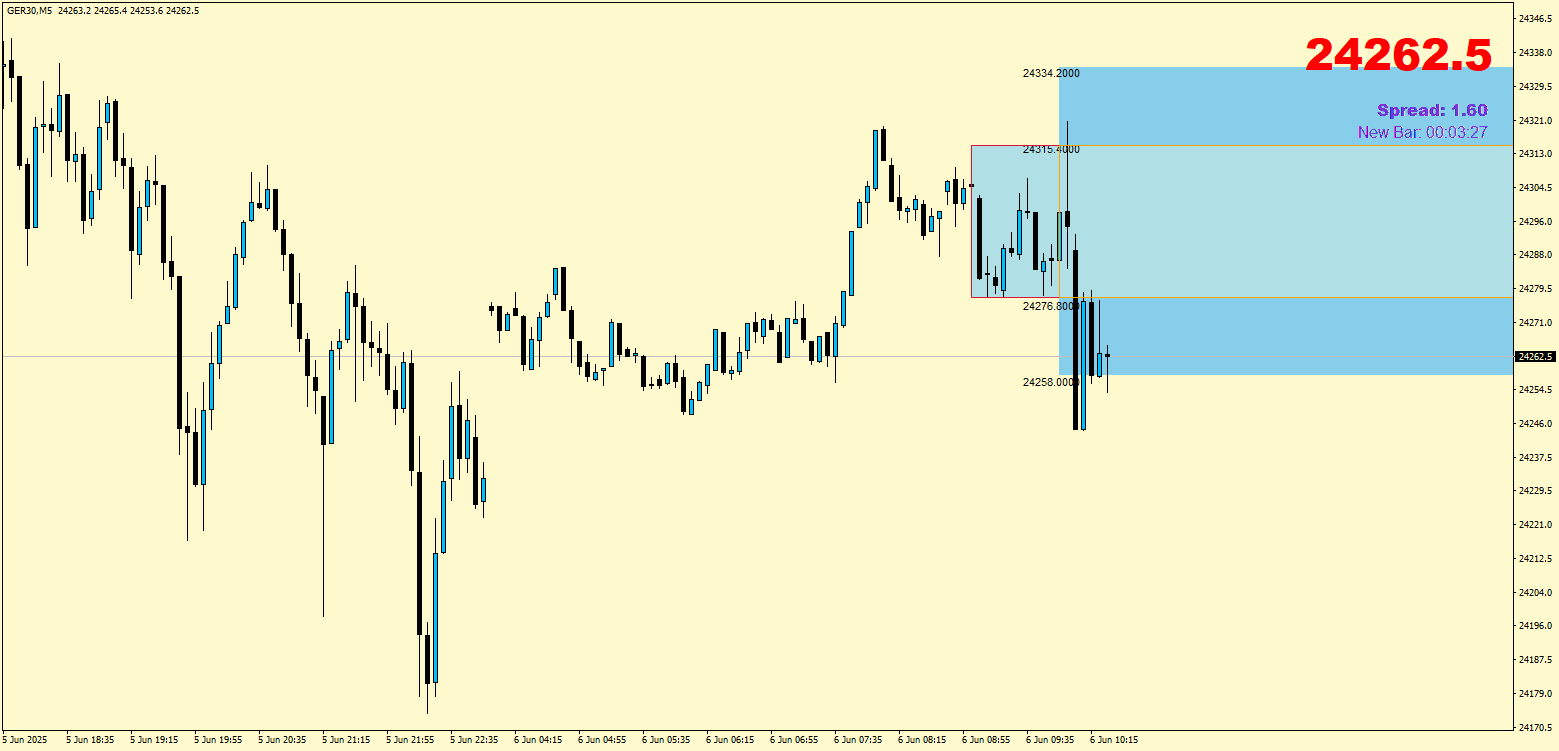

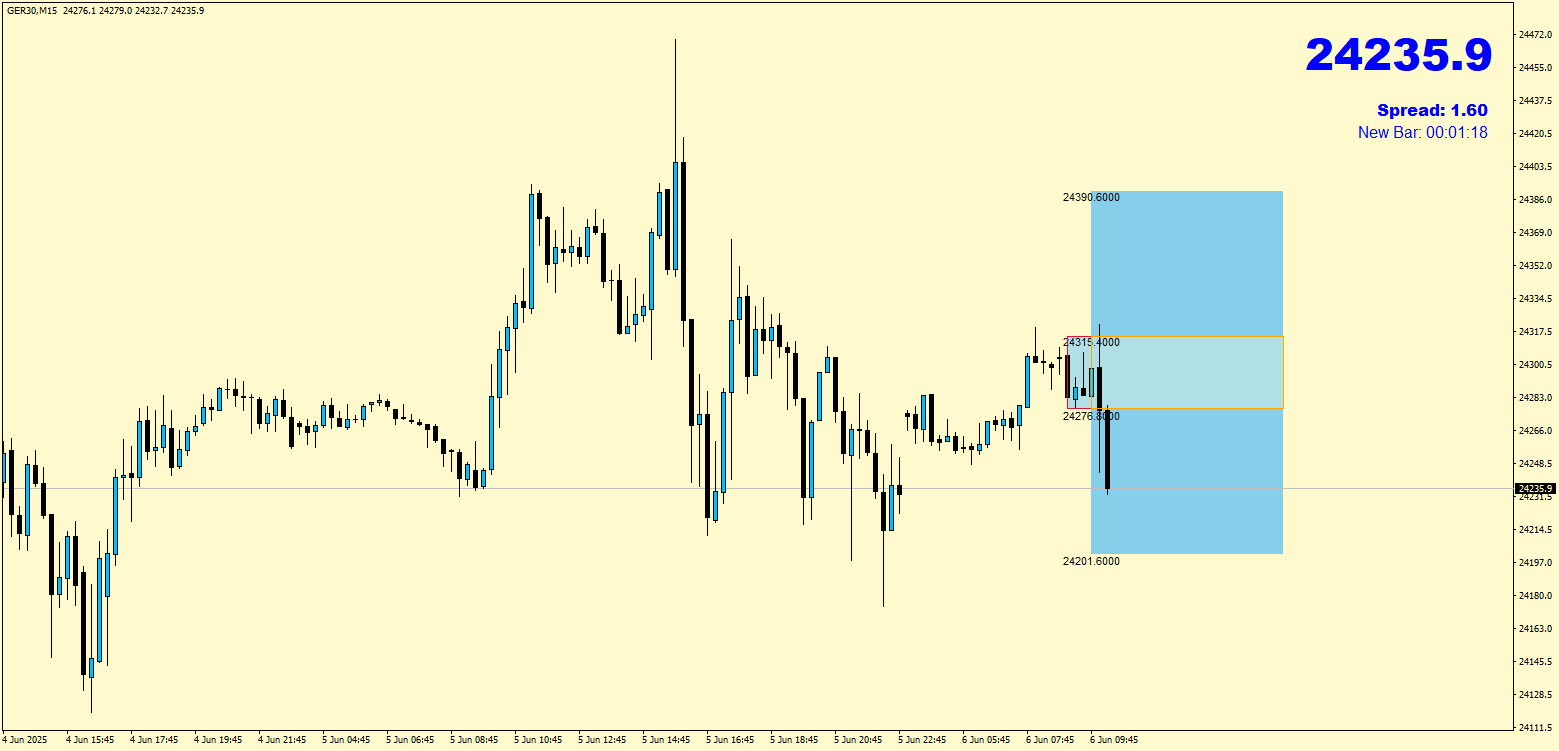

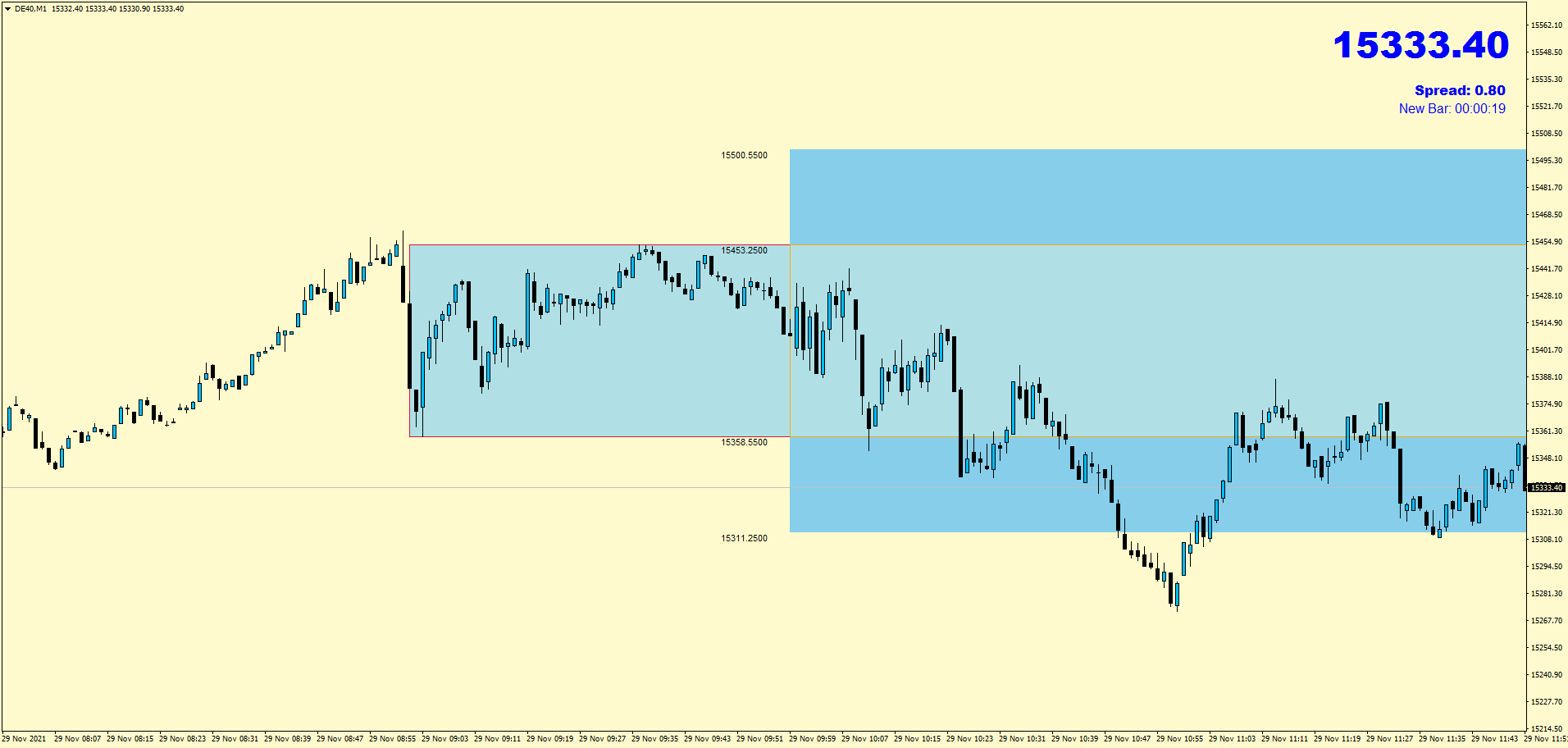

This strategy is executed on the 1-minute chart. The Open Range, also called the Opening Range, is defined, and a breakout after the official market opening is anticipated.

It can be applied to numerous markets such as stock indices (DAX, EuroStoxx, Dow, S&P 500 etc.), bonds (Bund-Future etc.),

commodities (WTI, Brent Oil etc.), precious metals (Gold etc.), and even individual stocks.

Currencies like EUR/USD will be supported soon and delivered via a future update.

There are many different approaches when it comes to defining the time range of the Open Range. While some traders use the high and low from 9:00 to 10:00 a.m. for the DAX, others recommend using, for example, 8:00 – 9:00 a.m., 8:00 – 9:15 a.m., or 9:00 – 9:45 a.m. Many traders prefer the DAX range from 8:01 – 9:00 a.m., as significant price moves can occur at 8:00 a.m., and therefore they wait an extra minute.

For the Dow or S&P500, the first 45 minutes after the stock exchange opens are recommended as the Open Range – typically from 3:30 p.m. to 4:15 p.m. However, each trader often has their own strategy here as well.

ORB – Trading Strategy with MetaTrader 4

Suitable for all indices, commodities, forex, and stocks based on CFDs such as:

Indicator – Open Range Breakout System for MetaTrader 4